Why Would CARB Create a New Locomotive Regulation That Eliminates Any Solutions That Are Available Now and Only Allow Solutions That Will Have a Very Little or Zero Technical, Operational, and Financial Chance of Working?

BEAUFORT, SC – June 20, 2024 – On April 22, 2024, CARB produced a new paper: Feasibility Analysis: Zero Emission Train from the Port of Los Angeles to Barstow. The problem is that this paper is technically incorrect and does not serve any purpose. 85% of the criteria and greenhouse gas (GHG) emissions in the rail sector (and California) come from line haul locomotives. All the locomotives in the original comparison are switchers or slugs with limited power, not real line haul locomotives. In nearly all areas of the U.S., when fully loaded, line haul locomotives must run at Notch 8 for many hours. Just like the CARB In-use Locomotive Regulations, it focuses on the zero emission solutions that are not affordable, not technically available or feasible, and will not work operationally within the next 30 years.

We will talk about the In-use Locomotive Regulations first before the analysis paper. However, before addressing the CARB In-use Locomotive Regulations, the following analysis paper provides insights that should be part of the overall narrative: Beyond Force: A Realist Pathway Through the Green Transition. Several of the points made are:

- It is time for a fundamentally new strategy. We must use government policy not to force change but to enable change through the widespread development of readily available technologies that meet the price and the performance levels of dirty energy.

- There is no evidence that forcing change with regulation, subsidies, or exhortation will work—and there is plenty of evidence it won’t.

- Companies will not adopt clean energy at the expense of growth, productivity, and lower costs.

- The market is the only lever powerful enough to drive the transition at the scale needed—and it will only work when clean energy technologies can outcompete dirty ones without subsidies or regulation. So, they must reach price/performance parity (P3).

- Many technologies will never reach P3; they are a waste of resources that should be invested into innovation. Governments should recognize the difference.

- Governments must focus all their policy efforts and tools on getting key technologies and solutions to P3. Everything else is a distraction. Without effective parity, all the subsidies, regulations, and exhortations in the world will be for naught.

I (Scott Myers) will now address how the CARB In-Use Locomotives Regulations reveal significant barriers to success. CARB has gone down a rabbit hole about locomotives, violating/ignoring the price/performance parity compared to diesel locomotives, thus guaranteeing that Battery-Electric and Green Hydrogen solutions will fail and causing the In-use Locomotive Regulations to fail. In addition, it disallows a solution that will work.

There are four potential technologies to convert to zero emission line haul locomotives from diesel. Remember that line haul locomotives, in nearly all areas of the U.S. when fully loaded, must run at Notch 8 for many hours. The potential solutions are:

- Battery-Electric (BEL)

- Green Hydrogen-Battery (GHB)

- Overhead Catenary System (OCS)

- RNG Hybrid (RNG)

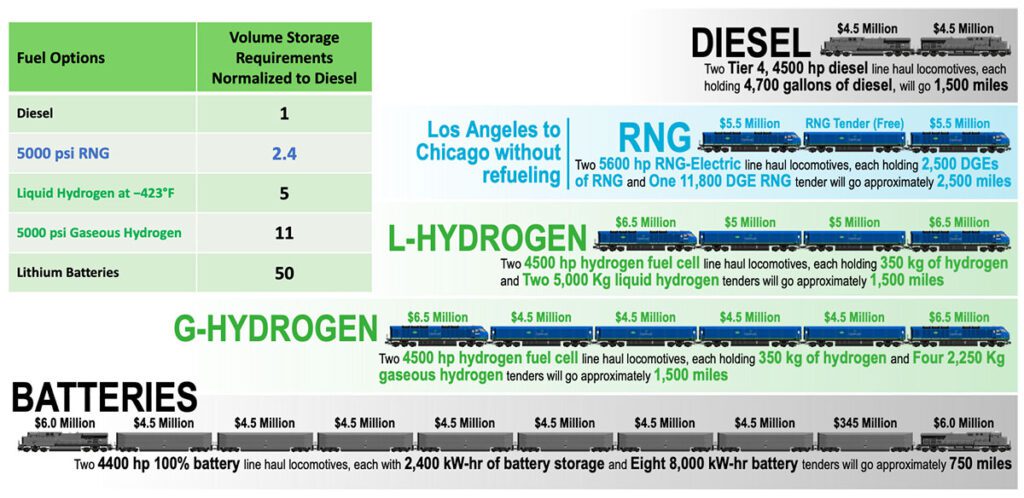

Use of Battery-Electric Line Haul Locomotives will cost trillions and will Never reach P3 within the next 30 years. Batteries are energy storage devices, not primary energy producers, and are not very good energy storage devices for locomotives. Lithium batteries require 50 times the volume to store energy compared to diesel. Lithium batteries are getting cheaper, but their Volumetric Energy Density (W-HR/L) will not get better due to physics. It is the volumetric density, not their gravimetric energy density, which limits the amount of batteries that can be used on mobile vehicles such as cars, trucks, and locomotives. LFP batteries require around 5 to 6 feet of locomotive length per 1 MW of batteries, including crash-worthy, FRA concurred mechanical structure, cooling and heating battery systems for -40 to +135 degrees Fahrenheit, anti-shock and vibration systems, and electrical connections. For a standard 75 foot line haul locomotive, around 35 feet are required for the cab, electronics, traction systems and other equipment, leaving around 40 feet for holding 8 MW of batteries.

That is essentially the amount of batteries on the Wabtec FLXdrive C-C battery slug with 7 MWh of batteries being used in Australia. It does not have FRA concurrence.

The Joule SD40JR switcher locomotive with PHL at the ports of Los Angeles and Long Beach, California was also built in Brazil and is rated at 2.4 MW. Progress Rail has some orders for the SD70J switcher locomotive with 8 MWh, for delivery over the next 2 to 3 years, but no FRA concurrence yet. The 79 foot Joule SD70-BB, while not built, was conceived for used in Brazil for mining, and is a B+B+B+B locomotive that can go only 50 mph and is a specialty item that is not being used in the U.S.

When designing any vehicle (cars, trucks, locomotives) using lithium batteries, the designer bases their operating window on only 60% of the overall rating of the batteries. Lithium batteries, like any battery, do not like to be charged to the top 20% of their storage capability (80% to 100%) or discharged to the bottom 20% (20% to 0%) – it shortens the life of the batteries. That means that the duty cycles of 8 MW BEL locomotives should be used for only 4.8 MW-hr of work between recharging. Also, if the environment is cold (below 32 degrees) or hot (over 110 degrees), the batteries will produce even less energy for work and/or take a longer time to recharge.

A BEL locomotive will have an efficiency of around 80% versus a diesel line haul locomotive that will be around 40%. That means that a BEL locomotive can operate twice as long as a diesel locomotive at the same workload. A gallon of diesel will produce about 37.1 kW-hrs. Replacing a standard 4,600 hp diesel locomotive carrying 5,000 gallons of diesel with a 4,600 hp (3,400 kW), 8 MW BEL line haul locomotive requires seven (7), 80 foot, 12.5 MW battery tenders to have the same range. One MW battery pack with batteries, FRA concurred structure, cooling and heating system, etc. will cost around $600 per kW or $600,000 a MW. A single 12.5 MW battery tender will cost over $8 million each, and the total cost to replace a standard 4,600 hp diesel locomotive with a 100% battery solution will be around $65 million. This number does not include the recharging stations required around the U.S., which will easily require $1-2 trillion dollars.

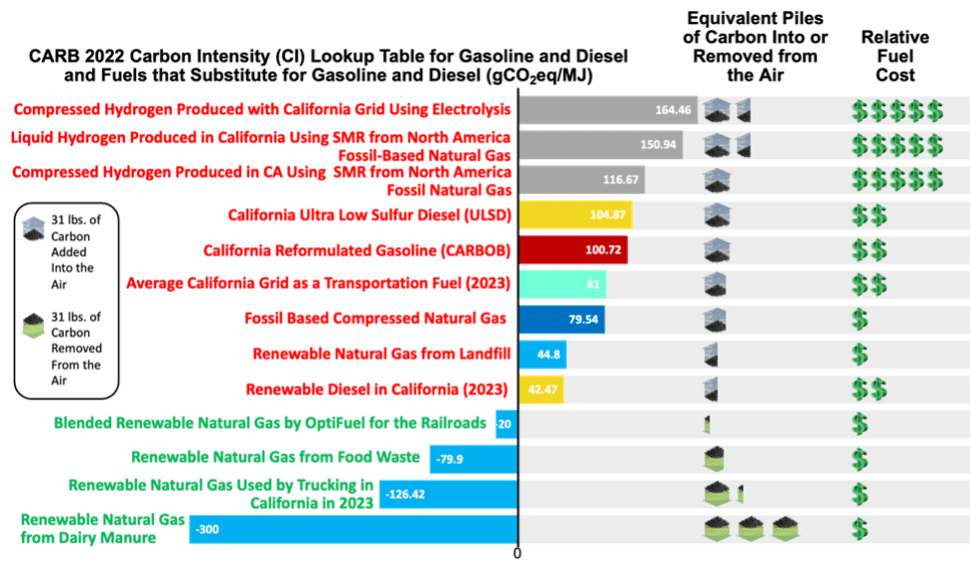

According to CARB’s own report, the CI of the average California electric grid as a transportation fuel in 2023 is 81. There is no real indication that the CI will go down very much over the next 10 to 20 years (https://greeninnovationindex.org/2023-edition), so the effective CI of a BEL locomotive is 40, 2.5 less than a diesel locomotive, the same as a diesel locomotive running on renewable diesel, and significantly dirtier than a RNG hybrid locomotive with a zero or negative CI.

As of January 2024, electricity in California costs around 30.44 cents per kilowatt-hour (kWh) on average. At 37.1 kW in a gallon of diesel and an efficiency increase of 2, the effective cost of a BEL locomotive in diesel gallon equivalence due to the same work is $5.65. On June 20, 2024, the retail price of diesel per gallon was $5.13, but the railroads normally pay 75% of that amount, or $3.85. That means that the railroads in California will pay 147% MORE in fuel cost to run a BEL locomotive compared to a diesel locomotive with the same workload. With OptiFuel providing RNG with a CI of Zero at $3.00 a DGE, a railroad in California will pay 188% MORE in fuel cost to run a BEL locomotive compared to a RNG Hybrid locomotive, and the RNG Hybrid locomotive will SAVE at least 25% in fuel cost compared to using a diesel locomotive.

Production cost of Green Hydrogen will always be ~6 times the cost of high-pollution gray hydrogen, and a green hydrogen solution will Never reach P3 within the next 30 years. 99.5% of all hydrogen produced in the world is Grey Hydrogen that has a Carbon Intensity of 117, greater than ULSD Diesel (104). It even has a 50% higher CI to 151 when you liquefy it to liquid hydrogen, even using the California power grid.

Gaseous hydrogen at 5,000 psi requires 10 times more storage volume than diesel, and liquid hydrogen at -432 F (-252.8 C) requires 4 times the storage volume than diesel. That is just simple physics that will never change.

85% of grey hydrogen is consumed at the point where it is manufactured because the cost of distribution is so high and there never will be a national hydrogen pipeline network to move the hydrogen to railroad refueling systems around the U.S. The U.S. Department of Energy calculates that it would take 14 hydrogen tanker trucks to move the same amount of energy as one diesel tanker truck (1.15 kg hydrogen equal 1 gallon of diesel). So, if you want to buy grey hydrogen now and have it delivered to your site, prepare to pay $25 to $36 a kg.

There will never be affordable Green Hydrogen for use for the rail market. What little Green Hydrogen produced over the next 30 years in the U.S. will go into the industrial market, if anywhere. The mining industry has already announced that they will not use Green Hydrogen to power mine operations and large mining trucks; they will go 100% electric. In Europe, the heads of the steel industry said recently, “Green Hydrogen is too expensive to use in our EU steel mines, even though we’ve secured billions in subsidies.” California has already eliminated Green Hydrogen as a fuel for cars and trucks, and large Class 8 truck fleets are going to renewable natural gas (RNG) for long-haul trucking, not Green Hydrogen that is not affordable. Why CPKC and CSX are even looking at hydrogen locomotives is a question only they can explain.

A line haul locomotive requires full power (Notch 8) for hours to cross the U.S. The Ballard fuel cells used in the 1,600 kW switcher locomotives that CPKC and CSX are testing can carry only 170 kg of grey hydrogen, and the fuel cell system net efficiency at FULL POWER (Notch 8) is 40%, about the same as a diesel or RNG internal combustion (IC) engine. Replacing a standard 4,600 hp diesel locomotive carrying 5,000 gallons of diesel with a 4,600 hp hydrogen line haul locomotive using the same technology on the CPKC and CSX locomotives would require a hydrogen locomotive that would be around 120 feet long (18 of the Ballard 200 kw FCWave systems) with two 80 foot hydrogen tenders, each carrying 2,875 kgs of hydrogen stored at 5000 psi. The cost of that configuration will be about $20 million, four times more than a new Tier 4 diesel line haul locomotive or ten times more than two zero emission 5,600 hp RNG hybrid line haul locomotives with one 80 foot, 11,800 DGE RNG tender.

Conversion to an Overhead Catenary System (OCS) across the U.S. will cost $2-3 trillion dollars and will Never reach P3 within the next 30 years. The American National Rail Network, covering freight, commuter, and passenger services, spans over 160,000 miles (260,000 kilometers) of track, making it the world’s longest and most interconnected rail system. By comparison, the European rail network, with 94,000 miles (151,000 kilometers) of track, is more than 40% smaller. Even then, the European network is only about 70% electrified, as the remaining routes do not generate enough traffic to justify the infrastructure cost. The larger loading gauge of American railways allows for bigger and heavier trains, resulting in significantly higher efficiency for American freight railways, which transport nearly three times more cargo per mile of track compared to European counterparts. Additionally, the adoption of a uniform, single track gauge across all classes of railroads (Classes 1, 2, and 3), along with standardized rail equipment, ensures interoperability and seamless operations across the entire U.S. rail network.

A new report from the Clean Freight Coalition indicates that full electrification of the U.S. commercial truck fleet would require nearly $1 trillion in infrastructure investment alone for the U.S. highway and road system. The Class 1 Railroads do not operate on U.S. highways, which are geographically integrated with the U.S. power grid and maintained by federal and state funds. The railroads must operate across mountains, deserts, lowlands, large bodies of water, and large plains for over 160,000 miles, large areas that have no existing power grids and associated power stations. The cost for an OCS will be more than the original cost to build the transcontinental railroads ($2.9 billion in current dollars), and maintaining the primary power stations, overhead lines, and local power substations will be incredibly expensive.

In CARB’s unrealistic Feasibility Analysis paper comparing solutions from the Port of Los Angeles (POLA) to Barstow, CARB suggested that one can convert Segments 2 and 3 only to OCS, a range of 80 miles. Segments 2 and 3 are triple tracked by BNSF and single tracked and sidings by UP independently up and down Cajon Pass. The cost to converted to OCS will be at least $8-10 million per mile for the actual OCS installation, and at least another $2 million per mile for the required substations and grid interconnection to a primary power source. The total cost will be at least $1-1.2 billion for the 80 miles over the pass. Who will pay for that, even before the cost of the required OCS-compatible locomotives?

Some additional points:

- Operational realities mean the train traveling between POLA and Barstow will likely slow or stop completely one or more times along the route as the dispatchers manage traffic flow across the busy corridor. Each acceleration will require a non-trivial amount of additional power not accounted for in the analysis.

- System Special Instructions provided by the railroad include guidelines which determine the number of locomotives needed for a given amount of trailing tonnage based on both needed tractive horsepower and braking horsepower.

A catenary system would be required over at least 2, if not all 3, mainline tracks plus appropriate amounts of yard trackage at either end of the route to allow the locomotives to be cycled between inbound and outbound trains. - Any solution which requires locomotives or tenders to be coupled to the train (say at POLA) and then removed from the train (say in Barstow) will involve a non-trivial time delay. This time delay will further reduce the competitiveness of trains vs. trucks, especially for intermodal type loads. As such, a poorly chosen “green” solution could actually increase pollution and highway congestion by driving freight to trucks. The point is, solving the pollution problem requires considering the operational impacts of choices which aren’t necessarily obvious in the simplistic CARB analysis. Sure, it is possible to deploy battery or fuel cell or catenary-powered trains to go from POLA to Barstow, but is it practical to do so, and will it have the intended outcome?

Renewable natural gas (RNG) is the only solution that will reach P3 in the next 5 years, costing the Class 1s around $28 billion using OptiFuel’s pioneering Locomotive-as-a-Service (LAAS™) program over a 15 year period to convert 25,000 line haul locomotives. In addition, the OptiFuel RNG hybrid locomotives would be zero NOx and PM criteria emissions and zero or negative GHG emissions. Society will always produce waste, which naturally emits surface-level methane into the atmosphere as it decomposes. This organic waste can be used as feedstock to produce Renewable Natural Gas (RNG).

RNG is NOT a fossil-based fuel and is the only renewable fuel with a negative carbon intensity. RNG production takes a product that is negatively impacting the environment — organic waste — and creates a clean, reliable energy resource that is fully compatible with our current rail infrastructure and operations, serving a productive role in the clean energy transition. Readily available RNG from landfill sites with a CI of +40 can easily be blended with 400 million DGEs of RNG with a CI of -350 from agriculture waste to provide 3 billion DGEs of final locomotive fuel with a CI of 0 or less for all 25,000 line haul locomotives in the Class 1 fleet.

Fortunately, U.S. railroads have a near-term solution within reach. By assessing natural efficiencies unique to the rail network and utilizing existing resources and tools, a clear path to decarbonizing rail with revolutionary optimization emerges. Post-World War II, the U.S. developed a 3-million-mile natural gas pipeline network alongside railways, establishing the most efficient fuel distribution system conceivable for railroad operations, which require the transport of more than 3.5 million gallons of fuel annually. With pipeline transport, refueling locomotives and tenders with RNG is more straightforward than refueling with diesel.

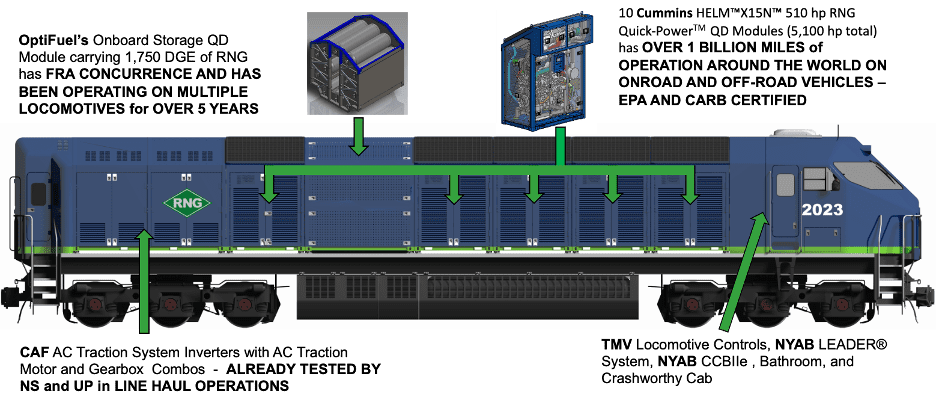

All Subsystems in OptiFuel’s Total-Zero™ 5,600 hp RNG Hybrid Line Haul Locomotive are at TRL 9, have DOT Certification and/or FRA Concurrence, and are in Production.

The Entire Operational System with Locomotive and 11,800 DGE RNG Tender is Expected to have FRA Concurrence by 2027 and Completion of Million Mile Operational Testing with 10 Locomotives and 5 Tenders by the End of 2028.

OptiFuel Total-Zero™ Locomotives deliver diesel-equivalent power and impressive operating distances. Two 5,600 hp R/CNG-powered line haul locomotives, along with one powered tender car, can travel 2,500 miles between fuel stops, out-running two 4,500 hp Tier 4 diesel locomotives by 1,000 miles.

Infrastructure supporting RNG-powered locomotives refueling is cost-effective and scalable, primarily requiring the addition of RNG dispensers to existing diesel refueling islands. This infrastructure has already been implemented at the Indiana Harbor Belt Railroad in Chicago five years ago (see video).

OptiFuel’s pioneering Locomotive-as-a-Service (LAAS™) Program makes affordability a reality. Through this program, railroads receive a fully integrated solution – including RNG-powered locomotives, tenders, refueling infrastructure, and RNG fuel – for one low, fixed-rate fuel price plus an upfront payment of about 20% of the retail price of the locomotive. For an OptiFuel Total-Zero™ 5,600 hp RNG Hybrid Line Haul Locomotive, this upfront payment would be approximately $1.1 million, covering up to 30 years of use.

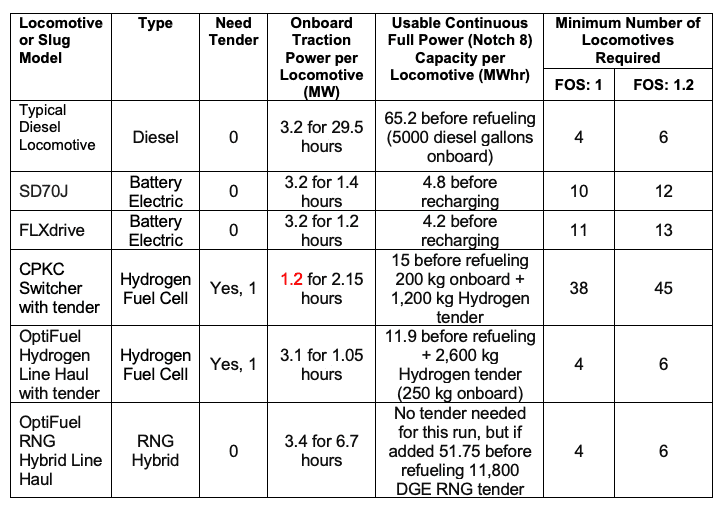

Updated Table 3 of CARB’s Feasibility Analysis Paper with realistic data. While there are many unrealistic assumptions in the paper, we will only address the original data in the four rows in Table 3.

Row 1: On a run with a typical diesel line haul locomotive from POLA to Barstow, the normal consist is 4 to 6 diesel locomotives, not 7 or 8.

Row 2: CARB specifically picked a BEL model that can carry a lot of batteries to make it look good. The 79 foot SD70-BB picked in the comparisons was conceived for used in Brazil for mining and is a B+B+B+B (8 axles) locomotive that can only go 50 mph, weighs 540,000 pounds (20% more than all the line haul locomotives), and theoretically, can carry 14.5 MW of batteries. If it was ever built, it would cost over $10 million due to the battery cost. It is a specialty locomotive item that is not being used in the U.S. network for line haul, and it is not clear that the SD70-BB would even get FRA concurrence to operate in the U.S.

The Joule SD40JR switcher locomotive with PHL at the ports of Los Angeles and Long Beach, California was also built in Brazil and is rated at 2.4 MW. It does have FRA concurrence. Progress Rail has some orders for SD70J switcher locomotive with 8 MWh, for delivery over the next 2 to 3 years, but no FRA concurrence yet. Yet, we used the SD70J switcher locomotive with 8 MWh for the comparisons.

So, with Row 2, we used a future Joule SD70J switcher locomotive with 8.0 MW of batteries so accurate data could be obtained. It has 3.2 MW of tractive power per locomotive and usable energy capacity per locomotive of 4.8 MWhr at 60% utilization. That means that the Joule SD70J can operate at Notch 8 for 1.4 hours before stopping and recharging. The minimal number of Joule SD70Js locomotives required for a factor of safety of 1 and a factor of safety of 1.2, respectively, is 10 and 12 locomotives. That is 2.5 times more than the numbers in Row 2 of Table 3.

Row 3: CARB does not seem to understand what the Wabtec FLXdrive system is. The FLXdrive is a battery-electric slug (a powered tender), meaning it works in conjunction with traditional diesel-electric locomotives to provide regenerative braking for a train consist. The first-generation FLXdrive slug, with a capacity of 2.4 MWh, was able to operate 30 to 40 minutes at full power when not being connected to another locomotive. It does not have FRA concurrence. On October 31, 2023, Wabtec unveiled their first production version of the FLXdrive at Wabtec’s Erie manufacturing facility. It carries 7 MWhr of lithium batteries and will be tested in Australia with Roy Hill moving iron ore essentially downhill in a consist with four additional Wabtec diesel locomotives. The single 7 MWhr FLXdrive slug will be used in the consist to recharge the lithium batteries with regenerative braking during the 344 kilometer (214 mile) downhill run. The 7 MWhr FLXdrive slug will be able to operate at Notch 8 for only 1.2 hours going back up the hill, then it is just additional dead weight that the diesel locomotives will have to carry up for the remainder of the trip up the mountain. Wabtec does not have FRA concurrence on the U.S. rail network.

Even though the FLXdrive was designed to work with other diesel locomotives, in Row 3 I substituted multiple FLXdrive slugs with 7 MW of batteries and no diesel locomotives. It would have 3.2 MW of tractive power per locomotive and usable energy capacity per locomotive of 4.2 MWhr based on 60% utilization. That means that the FLXdrive can operate at Notch 8 for only 1.2 hours. After that, it is dead weight. The minimal number of FLXdrive required for a factor of safety of 1 and a factor of safety of 1.2, respectively, is 11 and 13 locomotives. That is almost twice the original numbers in Row 3 of Table 3.

Row 4: The CPKC hydrogen hybrid locomotive is a switcher with a continuous power of 1.2 MW (1,600 hp) and can carry 210 kW of hydrogen. It has additional power from LFP batteries below the deck of the locomotive that can last for about an hour. It does not have FRA concurrence to operate in the U.S. at this moment and probably will not have concurrence with the existing prototype versions.

It cannot carry more batteries since the six Ballard 200 kw FCWave systems require 20 feet in length of the locomotive, and the hydrogen storage system requires another 20 feet for a total of almost 59 feet. If CARB wants to add another 6.9 MW of batteries per hydrogen locomotive, those batteries will probably have to go on a separate 80 foot battery tender, along with the hydrogen tender. Without the battery tenders, the minimal number of CPKC hydrogen hybrid locomotives required for a factor of safety of 1 and a factor of safety of 1.2, respectively, is 38 and 45 locomotives. That is 5 times more than the numbers in Row 4 of Table 3. At $25 a kg of grey hydrogen, the cost for the grey hydrogen for that one-way trip would be $91,000 for the 3,640 kg of hydrogen used. However, even that number of locomotives will not work since each of the locomotives has at most only 2.0 MW of tractive power with the combinations of fuel cells and batteries to go up the pass.

Row 5: However, OptiFuel can provide an 80 foot. 4,300 hp hydrogen fuel cell line haul locomotive. It will carry 250 kg of hydrogen using the same fuel cells, battery, and onboard hydrogen storage technology used on the SNR hydrogen switcher locomotives. This locomotive can be built for testing in 18 months, for approximately $7.5 million. It would use 24 of the new Ballard 120 kW XD fuel cells designed for the Class 8 trucking market and the same RNG/Hydrogen onboard storage modules that OptiFuel is using for our DOE 5,600 hp RNG Hybrid Line Haul Locomotive. Therefore, the minimal number of OptiFuel 4,500 hp hydrogen line haul locomotives required for a factor of safety of 1 and a factor of safety of 1.2, respectively, are 4 and 6 locomotives and one of OptiFuel’s 80 foot RNG/Hydrogen tenders that can carry 10,600 DGE of RNG or 2,600 kg of hydrogen. Those are the same numbers as typical diesel or RNG line haul locomotives that require no tender for the POLA to Barstow run. But once again, there will be no affordable green hydrogen for use for rail operations in the next 30 years.

Please note that CARB did not include the OptiFuel Total-Zero™ 5,600 hp RNG Hybrid Line Haul Locomotive in the comparison, despite the fact that CARB has been aware of the DOE program for four years. CARB is so convinced that every modality of transportation must use battery-electric as the solution that they ignored any near-term, affordable, low-risk solutions that are not battery-electric.

Row 6: If OptiFuel’s Total-Zero™ 5,600 hp RNG Hybrid Line Haul Locomotive was in the comparison table, the answer would be the same as typical diesel line haul locomotives, 4 to 6 locomotives. No RNG tenders are required since each RNG line haul locomotive carries 1,750 DGEs of RNG onboard.

Below is an updated Table 3 with corrected data and all options:

The bottom line is that none of the prototype locomotives/slugs used in the comparisons will reach P3. They are a waste of resources that should be invested into real solutions to solve real problems quickly. CARB needs to recognize the difference by understanding the impacts of physics, cost, operational requirements, and market forces, but unfortunately to date, they have not done so.

Reference OptiFuel white papers and press releases on our website under the News & Resources section:

- Zero Emission Line Haul Locomotives for $1.1 Million? OptiFuel Puts Renewable Fuel Credits to Smart Use for the Benefit of US Railroads

- Progression to Net-Zero Emission Propulsion Technologies for The Rail Sector

- 360 Degree 3D Animation of OptiFuel’s Total-Zero™ Modular Locomotive System

- OptiFuel’s Total-Zero™ 5600 hp RNG-Electric Line Haul Locomotive and RNG-Powered Tender are on Track for Testing at the Federal Railroad Administration’s Transportation Technology Center

- Rail Industry’s Path to Zero Emissions: Lessons from the Trucking Sector

- A Better, Affordable, Low Risk Approach Using Existing Technology Instead of CARB’s In-Use Locomotive Regulation, Which Will Hinder Progress

- Watch a RNG Locomotive Refuel

About OptiFuel Systems LLC:

OptiFuel Systems is a solution provider designing and manufacturing Total-Zero™ emission products and services in hard-to-abate transportation and industrial markets, specifically in rail, marine and power generation. OptiFuel works as a systems integrator with strategic partners to engineer innovative technology that is low-risk and modular with flexible fuel options consisting of affordable renewable natural gas (RNG) and hydrogen fuels. Products include switcher and line haul freight locomotives, RNG and hydrogen tenders, stationary and mobile refueling systems, and mobile and stationary standby and emergency generators. Services include sales, leasing, long-term maintenance, and refueling services. Customers are expected to achieve increased reliability, reduced lifetime maintenance costs, minimized downtime, greater sustainability, and an impressive up to 30% enhancement in fuel economy. OptiFuel’s Total-Zero™ RNG-electric locomotives and hydrogen-electric locomotives are EPA certified as zero NOx and PM emissions and have achieved FRA concurrence.